For employers with employees in multiple states, keeping up with numerous minimum wage rate changes can be a daunting task. While some states are on a schedule for annual increases to reach $15 an hour eventually, 12 states still adhere to the federal minimum.

A significant influence regarding the adjustments has been the increased rate of inflation that has swept the nation within the past year.

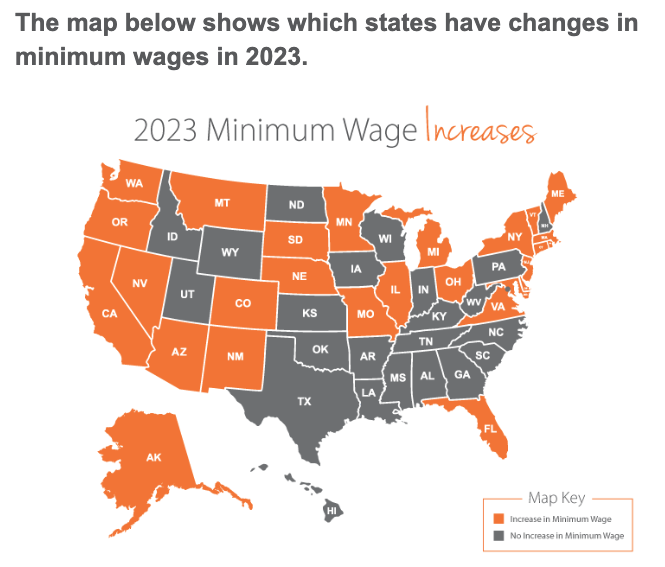

Visual Breakdown

To ensure your organization is aware of the latest minimum wage requirements, here is a visual breakdown by state.

Is the Federal Minimum Wage Rising in 2023?

No. The federal minimum wage has remained $7.25 since 2009.

More About Minimum Wage in the U.S.

In most cases, individual cities and municipalities have a higher minimum wage base pay than the minimum wage that is set at the state level. That said, 20 states have a minimum wage that is either equal to or lower than the federal minimum wage. Alternatively, other states have no minimum wage whatsoever. In those cases, the federal minimum wage is the default pay rate.

The minimum wage law, known as the Fair Labor Standards Act, applies to the employees of enterprises that have a total annual gross volume of sales or business of no less than $500,000. This law also applies to the employees of smaller firms as long as the employees are engaged in interstate commerce or the production of goods for commerce. For the record, this includes employees who work in the transportation and communications industries and regularly operate via interstate communications.

The minimum wage law also pertains to employees who work for federal, state, or local government agencies, as well as hospitals or schools. Employers that employ full-time students who work in retail or for service-related stores are also subject, as are those in the agriculture industry. Both colleges and universities might be able to obtain a certificate from the secretary of labor to declare that students can be paid as little as 85% of the applicable minimum wage.

For high school students who are at least 16 years old and also happen to be enrolled in vocational education-based classes, there are laws in place stating that they are not to be paid less than 75% of the minimum wage for the state in which they work. However, one caveat is that this only applies for as long as the student is enrolled in the vocation-focused educational program. Additionally, the employer must obtain the proper certification from the Secretary of Labor authorizing these conditions.

Turning our attention to people who often receive tips as part of their job, the waitstaff is perhaps in a position to experience the most significant exemptions. Waitstaff usually accepts a lower minimum wage rate because the tips are viewed as making up for the wage difference. However, if the employee’s pay is not equal to minimum wage, then the employer is required to reconcile the difference.

Note that exemptions tend to be narrowly drawn, so check with a professional before assuming that an exemption applies to your situation. Minimum wage changes can be triggered for a location when predetermined conditions are altered, so careful monitoring to ensure compliance with the latest wage levels for your business and region is a must.

Do you have questions?

If you have employees working and living in different states, this can get tricky. Give me a call if you have questions about payroll regulations and employment taxes.