October is a key month for business owners. With the busy holiday season just around the corner, it’s the perfect time to pause and reset your focus. Use this month for accounting prep, including:

- Checking in with your bookkeeper or accountant,

- Preparing early for 1099s and year-end reporting, and

- Discussing tax planning strategies before year-end.

This is also the perfect time to check the status of your books, review your numbers, and ensure everything is in order before year-end. A little preparation now helps you:

- Avoid the year-end scramble,

- Stay ahead of deadlines, and

- Finish the year strong.

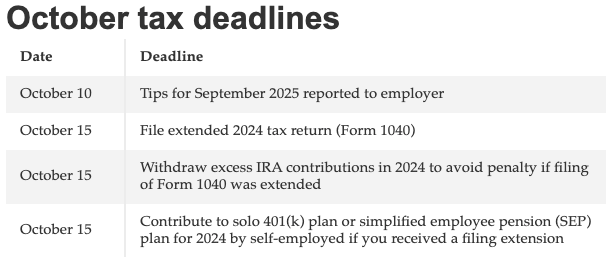

Upcoming Tax Deadlines

Most October deadlines only apply if you received a six-month tax filing extension. If that applies to you, be sure to meet the October 15 deadline to avoid penalties. Some taxpayers who received a filing extension can also contribute to or withdraw from certain accounts.

If you received more than $20 in tips during October, you must also report them to your employer by November 10.

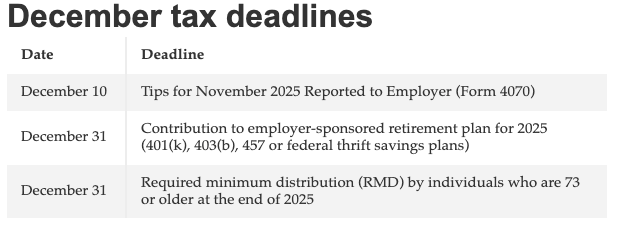

There are a few important tax deadlines in December. For one, it’s the last month to contribute to employer-sponsored retirement plan, such as your 401(k). Unless it’s your first, you must also take your annual RMD by the end of year.

Important Tax Deadline Change

For counties impacted by the severe storms, straight-line winds, and flooding that began on July 2, 2025, the IRS has automatically extended deadlines:

- Any filing or payment originally due between July 2, 2025, and February 2, 2026, now gets a new deadline of February 2, 2026.

This includes:

- Extended 2024 individual, business, and tax-exempt returns (normally due October 15, 2025).

- Estimated tax payments due September 15, 2025, and January 15, 2026.

- Payroll and excise tax returns due July 31, October 31, 2025, and January 31, 2026.

- Partnerships, S‑corps, corporations, and nonprofits with extended 2024 return due dates through February 2, 2026.

Preparation is Everything!

As we head into the busiest time of the year, preparation is everything. The last quarter often brings year-end deadlines, tax planning, and the holiday rush all at once, and it can feel overwhelming if you’re not ready.

Taking a little time now means fewer surprises later, smoother tax filing, and more energy to focus on finishing the year strong. Our team is here to help you stay on track, reduce stress, and keep your business running smoothly when it matters most.