You may have heard that auto depreciation limitations are getting a boost in 2024, and you’re curious about what that means for you, right?

Whether you’re a small business owner, a freelancer, or just someone trying to make sense of tax talk let’s break it down into simple terms, so you can understand how these changes might affect you.

When Can You Deduct Depreciation?

First things first, when we talk about deducting depreciation, we’re talking about the wear and tear on your vehicle over time. The IRS knows that the minute you drive a new car off the lot, its value starts to drop. If you use that car for business, you can deduct this loss in value from your taxable income.

You can start deducting depreciation when:

- You own the vehicle.

- You use the vehicle for business purposes.

- The vehicle’s lifespan is determinable (which it is for most vehicles).

- You expect the vehicle to last more than one year.

What Types of Vehicles Are Affected?

Not all vehicles are treated equally under the IRS rules. The new increase in depreciation limitations mainly affects passenger vehicles, which include:

- Cars

- SUVs

- Small vans

- Pick-up trucks

These are the types of vehicles that, if used for business, might see a bump in the amount you can deduct for depreciation in 2024.

Depreciation & Bonus Depreciation

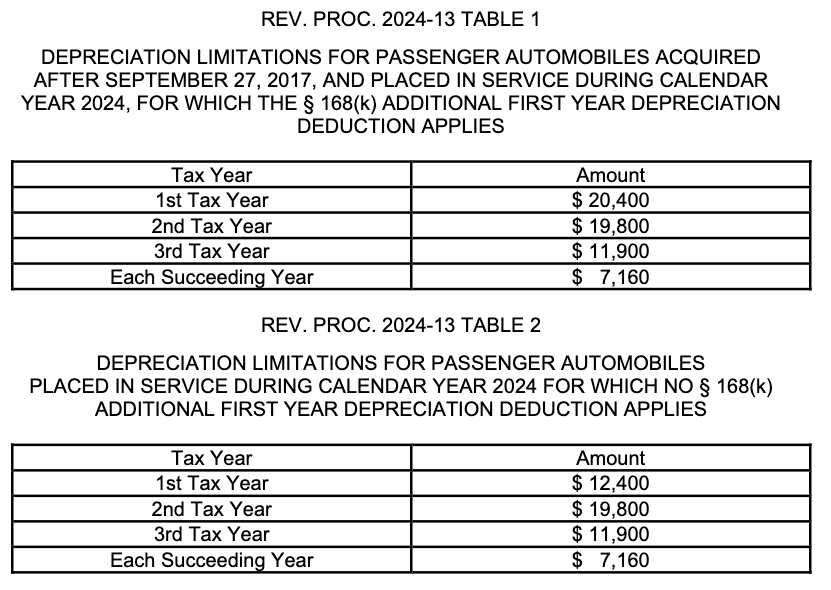

Depreciation is like the financial version of your car’s aging process. For 2024, the IRS has increased the limits on how much you can deduct for depreciation, making it a bit more generous.

- Standard Depreciation: This is the amount you can deduct each year over the life of the vehicle. The IRS sets limits to keep things fair, and these limits have been increased for 2024.

- Bonus Depreciation: Sometimes, the IRS offers a bonus (think of it as a tax-time treat) that lets you deduct more in the first year. This is especially handy if you’ve just bought a new vehicle for your business.

Additional First-Year Depreciation

For some vehicles, the IRS allows an additional first-year depreciation deduction. This is on top of the standard and bonus depreciation and can significantly lower your taxable income in the year you buy the vehicle.

- When It Applies: This extra deduction usually applies to new vehicles that are used more than 50% for business purposes.

- Limitations: There are specific limits on how much extra depreciation you can claim, and these limits have been increased for 2024.

Source: IRS

No Additional First-Year Depreciation

However, not all vehicles qualify for this extra bonus. Generally, if your vehicle doesn’t meet certain criteria (like being over a certain weight limit or not being used enough for business), you might not get this perk. It’s kind of like being left out of a VIP club, but for tax deductions.

The increase in auto depreciation limitations for 2024 is a welcome change for business owners and freelancers who use their vehicles for work. It means you can deduct more from your taxes due to the natural aging of your vehicle, which is a nice silver lining to the inevitable decline in your car’s value.

Automobile depreciation deductions can be complex and make a significant difference to the amount you owe on your taxes. The actual amount, however, can be tricky to figure out. That’s why it’s always a good idea to consult with my team for personalized assistance in determining your deductions and maximizing your tax savings.